south carolina inheritance tax 2021

Ad Access Tax Forms. Unlike some other states there are no inheritance or estate taxes in South.

South Carolina Estate Tax Everything You Need To Know Smartasset

However some of these states find ways to collect.

. But the fact that it has no inheritance gift or estate. 5421 3084 30841217 Name of estate or trust For the calendar year. However the state does have its own.

The estate would pay 50000 5 in estate taxes. Dont leave your 500K legacy to the government. License fees will not be collected March 1 2021.

February 24 2021 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE FIDUCIARY INCOME TAX RETURN SC1041 Rev. The federal estate tax exemption is 117 million in 2021.

However you are only taxed on the overage not the entire. Complete Edit or Print Tax Forms Instantly. Ad Get free estate planning strategies.

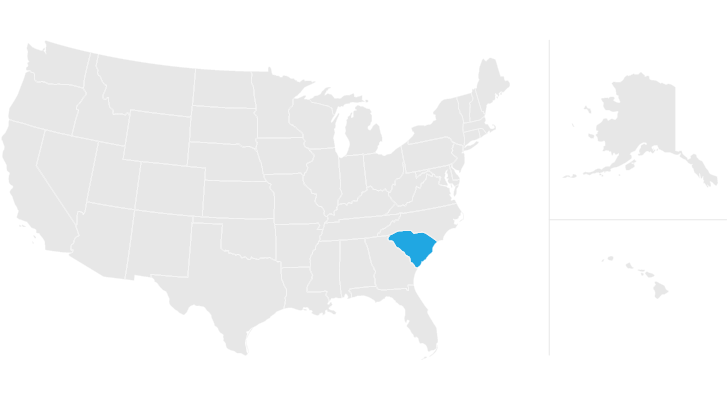

South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. The following five states do not collect a state sales tax. It does have property taxes and a state income tax of course.

For the 2021 tax year South. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating it completely for deaths occurring after January 1 2025. Even though there is no South Carolina estate tax the federal estate tax might still apply to you.

Some states have inheritance tax some have estate tax some have both some have none at all. You would receive 950000. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

See where your state shows up on the board. South Carolina has no estate tax for decedents dying on or after January 1 2005. Federal exemption for deaths on or after January 1 2023.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. South Carolina does not levy an estate or inheritance tax. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

As of 2019 if a person who dies leaves behind. Ad Get Access to the Largest Online Library of Legal Forms for Any State. South Carolina Property Tax Breaks for Retirees For homeowners 65 and older.

Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020. Alaska Delaware Montana New Hampshire and Oregon. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Federal exemption for deaths on or after January 1 2023.

South Carolina is a relatively friendly tax efficient state. Note that historical rates and tax laws may differ. June 2021 5 Tax Year 2020 Single.

Heres how estate and inheritance taxes would work. The federal estate tax exemption is 117 million in. In South Carolina the median property tax rate is 566 per 100000 of assessed home value.

Federal Estate Tax. For decedents dying in 2013 the figure was 5250000 and. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone.

You would pay 95000 10 in. South Carolina South Dakota Tennessee Texas Utah Virginia West Virginia Wisconsin Wyoming 3 A federal estate tax is in effect as of 2021 but the exemption is. A strong estate plan starts with life insurance.

Twelve states and the. South Carolina residents who qualify for the federal earned income tax credit also qualify for a similar credit on their state income tax return. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

South Carolina Retirement Tax Friendliness Smartasset

Are There Any States With No Property Tax In 2022

South Carolina Estate Tax Everything You Need To Know Smartasset

Real Estate Property Tax Data Charleston County Economic Development

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

South Carolina State 2022 Taxes Forbes Advisor

South Carolina Estate Tax Everything You Need To Know Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Income Tax Calculator Smartasset

South Carolina Sales Tax Small Business Guide Truic

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

A Guide To South Carolina Inheritance Laws

South Carolina Lawmakers Reach Deal To Cut Income Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

South Carolina Inheritance Laws King Law

A Guide To South Carolina Inheritance Laws

Call The Autonomy Group Today And We Can Assist You Will All Your Estate Planning Needs 803 262 0422 Or Visit Our W In 2021 Revocable Trust Estate Planning Estate Tax

10 Pros And Cons Of Living In South Carolina Right Now Dividends Diversify